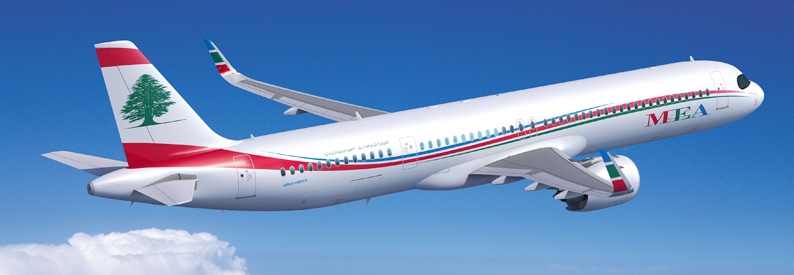

French companies are interested in investing in certain sectors of the Lebanese economy that have been earmarked for partial or complete privatisation, in particular national carrier MEA - Middle East Airlines (ME, Beirut), the newspaper al-Akhbar reported.

Pierre Duquesne, France’s ambassador in charge of coordinating international support to Lebanon, visited Beirut on February 3 to meet Prime Minister Najib Mikati and a number of government ministers and business leaders.

The central bank, Banque du Liban, is currently conducting studies to determine the airline’s market value, which according to preliminary information is estimated at more than USD1 billion, the daily said. A law is being drawn up to sell a 49% shareholding.

French shipping and logistics giant CMA CGM, which last year laid out plans to purchase a stake of up to 9% in Air France-KLM and has been working on developing its own new air cargo division CMA CGM Air Cargo (2C, Paris CDG), aims to “acquire a large stake” in Middle East Airlines, sources told the newspaper.

However, sources close to the French company said it had been offered only 10% of the Lebanese company’s shares, and MEA’s chairman and managing director, Mohamad Elhout, has been quoted as saying that if a privatisation proposal is implemented, any purchase of a stake will be restricted to a ceiling of 3%.

A year ago, CMA CGM won a 10-year contract beginning in March 2022 to run the container terminal at Beirut port, which was partially damaged in a blast at the port in August 2020 that killed more than 200 people. The company's chief executive is French-Lebanese Rodolphe Saade, the son of its founder, and is 73% owned by the family through its Merit France holding.

MEA - Middle East Airlines did not immediately respond to ch-aviation’s request for comment, and CMA CGM declined to comment.