After a three-day hearing concerning Jet Airways (Mumbai International), India's National Company Law Tribunal (NCLT) has reserved its decision after the airline's owners, the Kalrock Capital-Murari Lal Jalan consortium, sought orders to force a syndicate of lenders to allow the consortium's takeover of the airline to finalise.

Krishnendu Datta, appearing for the consortium in the matter of State Bank of India (SBI) vs. Jet Airways India Limited in Mumbai this week, said the lenders, led by the SBI, wanted to modify a resolution plan agreed to by all parties and approved by the NCLT in June 2021. But counsel for the lenders said the consortium was also attempting to modify the plan regarding agreed payments and providing undertakings to meet them.

The lenders, out of pocket from the 2019 Jet Airways collapse, want undertakings from the Kalrock Jalan consortium that deferred payments, per the resolution plan, will be fully paid. At stake is INR5.86 billion rupees (USD70.6 million) in future payments - just 5% of the amount Jet Airways owed the lenders when it collapsed. Counsel for the lending syndicate said his clients were doubtful whether they would get even this amount unless undertakings were provided.

But Datta told the tribunal that the resolution plan cannot be modified to suit the lender's changing wishes. "Now they want to change the contours of the financial plan," he said. “The lenders suddenly find themselves unsatisfied after eight months after the effective date (May 20, 2022). They now want additional funds. This is totally unacceptable and contrary to the resolution plan."

Meanwhile, India's Financial Express is reporting on the bank guarantees and security provided to the lending syndicate regarding some previously due payments. Two commercial properties in Dubai, one located in Jebel Ali Industrial First and the other Al Quoz, were included in the resolution plan as security against two payments due from the consortium, the first for INR1.85 billion (USD22.3 million) and the second for INR1.95 billion (USD23.6 million). Both properties were valued at over INR1 billion (USD12.1 million) each and were provided to the lending syndicate with a release date in the fifth year.

The lenders have also obtained control of a third Jet Airways property located in Dubai's Bandra Kurla Complex, however, this transaction was outside the formal resolution plan and not officially deemed as a security. Nonetheless, the Financial Express reports this property is valued at approximately INR500 million (USD6 million). The third property was provided with the same release date terms.

The extent of the bank guarantees are unknown, but the lending syndicate is seeking further undertakings from the Kalrock Jalan consortium. But their counsel told the tribunal that the consortium was refusing to do so, and that refusal superseded the resolution plan.

However, Datta told the tribunal any changes to the plan would breach s.31 of India's Insolvency and Bankruptcy Code 2016. "The moment I agree to such an undertaking then I would be in breach of the plan. The conduct of the lender leaves much to be desire," he said.

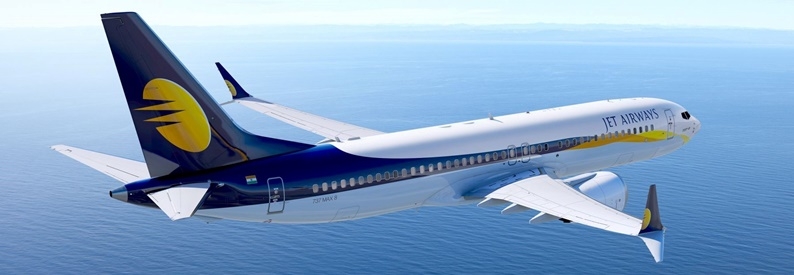

Meanwhile, the legal tussle over money is preventing the relaunch of Jet Airways. The airline's new owners have a valid air operator's certificate but slot allocations have been lost due to relaunch delays and fleet decisions remain unresolved. Jet Airways says it intends to restart with just six B737s before scaling up to 111 planes by the fifth year of operations.